Credit cards are just great, aren’t they? They allow you to get vouchers, earn cashback as you spend, and enjoy discounts at selected merchant stores.

Whether you are new to credit cards or a die-hard credit card user, the one thing many tend to overlook is the hefty annual fees.

These annual fees are a fixed cost and are charged once a year. So whether you use your credit card regularly or not, the fees are there just to keep your card account open.

FYI most credit cards charge an annual fee that ranges from RM80 to RM300.

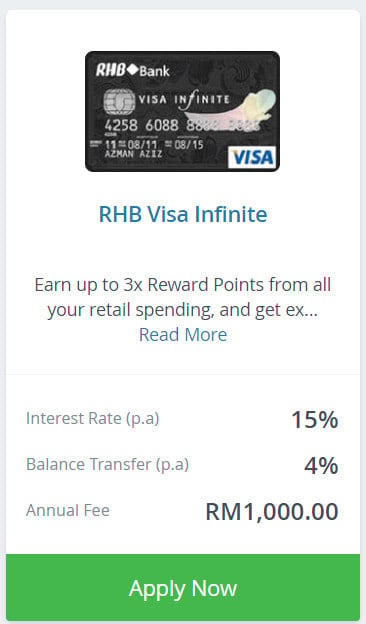

In fact, there’s one particular premium credit card that charges a whopping RM1,000!

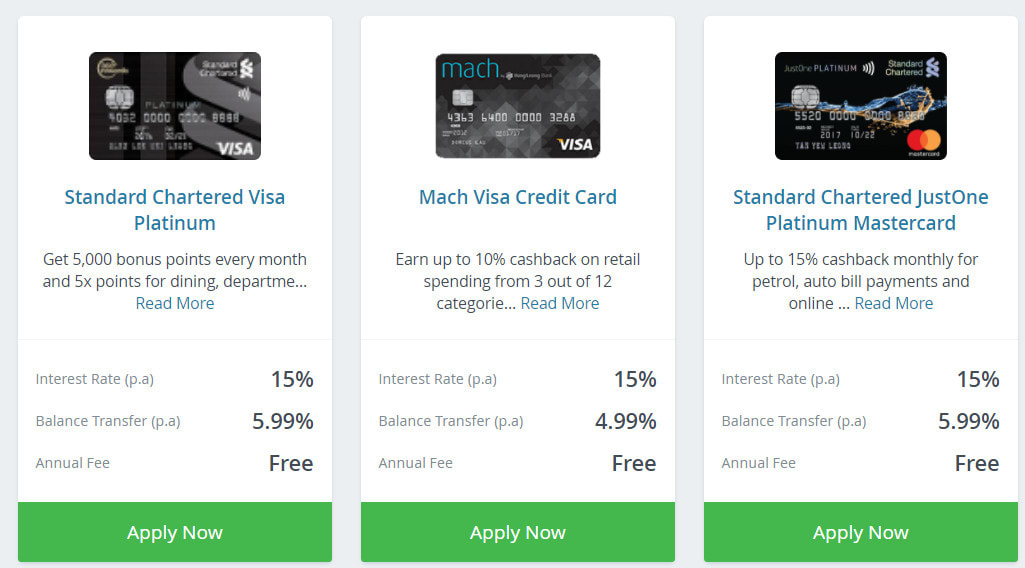

Of course, banks do offer credit cards with no annual fee, but these usually come with little benefits.

On the other hand, credit cards with high annual fees usually offer many perks, such as 15% cashback on Zalora, 8x rewards when you buy groceries from Aeon, 1.5% rebate when you dine at Kenny Rogers Roaster, and the list is endless.

So the big question is; with all these benefits, is your credit card worth the annual fee?

Calculating the worth of your credit card’s annual fee:

Because the annual fee increases the cost of owning a credit card, the benefits of owning the card should outweigh its costs.

To simply put, the rewards you’ve redeemed when converted to cash value should exceed the amount that you’re paying to enjoy these rewards.

Formula:

Worth of rewards collected > Annual fee’s worth

So if your credit card’s annual fee is RM100, the rewards and discounts you’ve claimed should be worth more than RM100.

Simple right? Better yet, in some credit card offerings, the annual fee is waived if your spending exceeds a certain amount in a given year.

So, if you’re an avid spender (be really honest about this!), you could opt for such credit cards. Just make sure to be mindful of your usual spending habits, and you’ll be surprised to find that there’s no need to pay an annual fee.

Wait, there’s more; assessing your "Brand Loyalty"

Are you loyal towards a particular brand, restaurant, hotel, cinema, airline or likewise? If yes, it makes financial sense to pay the annual fee for a credit card associated with that brand.

You could also go for a co-branded credit card. Co-branded cards let you earn extra discounts, rewards, and points whenever you purchase from the sponsoring merchant, such as Shopee or Lazada.

Although these cards bear the logo of the partner merchant, co-branded credit cards work just like any other credit card. They are accepted anywhere within the card network.

Conclusion

The main point is, paying an annual fee on a credit card isn’t necessarily a bad thing. That is, if you fully utilize the rewards that come with owning that card.